Off-Plan vs Ready Properties in Dubai: Which Makes More Money in 2026?

Every serious property investor in Dubai eventually faces the same decision.

Do you buy off-plan and wait for appreciation, or do you buy a ready property and start earning immediately?

There is no universal right answer. Anyone who tells you otherwise is oversimplifying the market. The real question in 2026 is not which option is better, but which option makes more money for your situation, timeline, and risk tolerance.

Dubai offers both choices at scale. Understanding how returns are created in each is what separates informed investors from reactive ones.

How Money Is Made in Off-Plan Property

Off-plan investments in Dubai are built around one core idea.

You buy early, you pay gradually, and you benefit from price movement before handover.

In 2026, this model is more structured than it was in earlier cycles. Projects are regulated, escrow-protected, and mostly delivered by developers with established track records. That reduces risk, but it does not remove it entirely.

Off-plan profits typically come from:

- Lower entry prices compared to completed units

- Capital appreciation during construction

- Flexible payment plans that preserve liquidity

According to Dubai Land Department transaction data, off-plan units are still launched at prices below comparable ready properties in the same communities. This gap is where appreciation potential comes from.

However, returns are not immediate. Rental income only begins after handover, and resale profits depend on market conditions at completion.

This is why off-plan properties in Dubai tend to suit investors who can wait and who are comfortable with delayed cash flow.

👉 Talk to a Property Expert in Dubai, UAE

Rahul Dubey

How Money Is Made in Ready Property

Ready properties work differently.

You buy at a higher entry price, but income starts immediately. Rent offsets holding costs, and in many cases covers mortgage payments.

In 2026, rental demand across established communities remains strong, supported by population growth and limited availability in prime areas. According to CBRE Middle East, average gross rental yields in Dubai continue to range between 6 and 8 percent in well-located projects.

Returns from ready properties typically come from:

- Immediate rental income

- Stable occupancy

- Long-term capital appreciation

Ready properties tend to attract investors who prioritize cash flow and lower execution risk. There is no construction delay and no dependency on future handover conditions.

The trade-off is a higher upfront cost and usually slower price growth compared to early-stage off-plan units.

Off-Plan vs Ready Property: Core Financial Comparison

The difference becomes clearer when both options are compared directly.

| Factor | Off-Plan Property | Ready Property |

| Entry price | Lower | Higher |

| Rental income | After handover | Immediate |

| Capital appreciation | Higher potential | Moderate |

| Cash flow | Delayed | Stable |

| Risk profile | Medium | Lower |

| Ideal holding period | Medium to long term | Short to long term |

Sources: Dubai Land Department, CBRE Middle East, Knight Frank UAE.

This table reflects averages. Individual project quality and location still matter more than the category itself.

Which Option Produces Higher Returns?

This depends on timing and intent.

According to Knight Frank UAE residential market reports, investors who enter strong off-plan projects early in the cycle often see higher percentage gains by completion. However, these gains are unrealized until resale or handover.

Ready properties, on the other hand, tend to deliver steadier returns over time, especially when held in high-demand rental zones. Over a ten-year period, total returns can be comparable, but the cash flow pattern is very different.

Off-plan rewards patience.

Ready property rewards consistency.

Matching the Investment to the Investor

One of the most common mistakes investors make is choosing based on headlines rather than personal strategy.

| Investor Profile | Better Fit | Reason |

| First-time investor | Ready property | Immediate income and lower complexity |

| Long-term wealth builder | Off-plan | Appreciation over development cycle |

| Cash-flow focused buyer | Ready property | Rent starts immediately |

| Capital growth focused buyer | Off-plan | Lower entry price and price uplift |

| Residency-focused buyer | Either | Depends on budget and timing |

Choosing correctly often matters more than choosing aggressively.

Market Conditions in 2026 Favor a Balanced Approach

In earlier years, investors often leaned heavily toward one side. In 2026, the market supports both.

Off-plan supply is disciplined, and reputable developers dominate new launches. Ready property demand remains strong due to population growth and limited availability in mature communities.

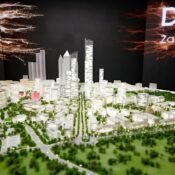

Developers such as Sobha Realty reflect how off-plan projects are now positioned as long-term assets rather than speculative trades. At the same time, resale properties in established areas continue to attract tenants and end users.

This balance is one reason Dubai’s market feels stable rather than overheated.

Liquidity and Exit Considerations

Liquidity matters, especially for investors who may need flexibility.

Ready properties generally offer easier resale because buyers can inspect the unit and income history is visible. Off-plan units can also be resold, but pricing depends heavily on project progress and market sentiment at the time.

According to DLD transaction trends, resale volumes remain strongest in completed, well-located communities. This is worth factoring into any exit strategy.

Which One Makes More Money in 2026?

There is no single winner.

Off-plan properties can generate higher percentage returns if bought early, chosen carefully, and held through completion. Ready properties often deliver more predictable income and lower stress.

The better option is the one that aligns with:

- Your cash flow needs

- Your investment horizon

- Your risk tolerance

Investors who understand this usually perform better than those chasing whichever option is trending at the moment.

For buyers weighing both paths, discussing options with a local expert often brings clarity. Comparing specific projects, rental data, and payment structures can help avoid costly missteps. Investors exploring this decision can seek guidance through the Pin Homes Real Estate team to align strategy with real market conditions.

Disclaimer

This article is for informational purposes only and does not constitute financial or legal advice. Property investments carry risk, and buyers should conduct independent due diligence or consult qualified professionals before making any investment decisions.

Recent Posts

For More Details

Pin Homes Real Estate LLC

Contact Real Estate Experts