Can Foreigners Buy Property in Dubai? Rules, Areas & Benefits (2026 Guide)

Dubai has long been a magnet for international property investors. But many buyers still ask a straightforward question: Can foreigners legally buy property in Dubai, and what should they know before making a purchase?

The answer is yes, and the rules are clear. Dubai offers well-defined frameworks for foreign ownership, along with opportunities across both off-plan and ready properties. Understanding these rules, the best areas to invest, and the benefits is crucial for making smart decisions in 2026.

Foreign Ownership in Dubai: How It Works

Foreigners can buy property in Dubai through freehold or leasehold arrangements. The type of ownership depends on the location:

| Ownership Type | Key Features | Examples of Areas |

| Freehold | Full ownership, including the land and property | Downtown Dubai, Dubai Marina, Sobha Hartland |

| Leasehold | Ownership for a limited period, usually 99 years | Certain business districts or older developments |

| Usufruct / Musataha | Rights to use property for a long period, often 50–99 years | Some government or legacy plots |

Source: Dubai Land Department, UAE Government portals.

Freehold areas allow foreigners to buy, sell, and rent out property with minimal restrictions, while leasehold and Musataha rights are more limited but still provide secure investment opportunities.

👉 Talk to a Property Expert in Dubai, UAE

Rahul Dubey

Eligibility: Who Can Buy

Most foreigners can purchase property in Dubai with minimal barriers:

- No residency requirement is needed to buy.

- Payments can be made via international bank transfers.

- Developers typically require a valid passport and proof of income.

- Certain projects may have restrictions for non-residents, but these are clearly stated upfront.

Dubai has simplified foreign property investment to attract international capital while protecting buyer interests. Payment structures, escrow accounts, and developer accountability ensure transparency.

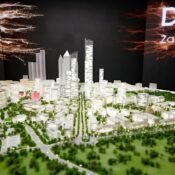

Top Areas for Foreign Investors in 2026

Foreign buyers often focus on areas that combine rental demand, capital appreciation, and lifestyle appeal. Here are the top 10 areas suitable for foreigners:

| Area | Investment Appeal | Example Projects |

| Downtown Dubai | Iconic address, high rental demand | Binghatti Titania Majan |

| Dubai Marina | Waterfront lifestyle, strong expat rentals | Hilton Residences Dubai |

| Sobha Hartland | Luxury gated community, family demand | SkyVue Altier Sobha Hartland |

| Jumeirah Village Circle | Mid-market, high rental yield | One Park Central JVC |

| Business Bay | Urban lifestyle, professional rentals | Sobha Skyparks |

| Dubai Hills Estate | Upscale villas, family-focused | Palace Villas – Ostra |

| Dubai South | Affordable entry, airport proximity | Samana Ocean Pearl |

| Dubai Sports City | Family-friendly, affordable apartments | Binghatti Hillcrest |

| International City | Budget-friendly, high rental yield | Rosewell Town Square by Nshama |

| Meydan | Premium projects, long-term growth | The Symphony Meydan |

These areas offer a combination of legal clarity, rental demand, and lifestyle appeal, making them ideal for foreign investors in 2026.

Benefits of Buying Property in Dubai for Foreigners

Investing in Dubai offers multiple advantages:

| Benefit | Details |

| Tax Efficiency | No capital gains, property, or rental income tax |

| Residency Potential | Property-backed visas for qualifying investors |

| Transparent Ownership | Escrow accounts, developer regulations, DLD registration |

| Rental Demand | Strong tenant base from expats, professionals, and families |

| Capital Growth | High-demand areas show steady appreciation over time |

Sources: Dubai Land Department, Knight Frank UAE, CBRE Middle East 2025.

Dubai’s legal and regulatory framework ensures that foreign buyers enjoy both safety and clarity, which is rare compared to many global markets.

Steps for Foreign Buyers

- Choose a freehold or eligible leasehold area.

- Identify a reputable developer or project. (Sobha Realty Projects)

- Verify payment plans and escrow account setup.

- Complete the purchase with developer and DLD registration.

- Arrange property management if renting out. (Property Management Services Dubai)

Foreign buyers can manage their investment efficiently from abroad or through local agencies.

Common Questions from Foreign Investors

Can I get a mortgage as a foreigner?

Yes, many banks offer mortgages to non-residents, though terms vary. Minimum down payments often start at 25–30 percent.

Do I need a residency visa to buy?

No, but owning qualifying property may allow you to apply for a long-term visa.

Which areas offer the highest rental income?

Budget-friendly communities like International City and Dubai Investments Park provide higher gross yields. Prime areas like Downtown Dubai and Dubai Marina may have slightly lower yields but higher capital growth potential.

Conclusion

Foreigners can safely and legally buy property in Dubai. The market offers a variety of options across price points, rental yields, and lifestyles. Choosing the right area and property type requires understanding local rules, tenant demand, and investment horizon.

For guidance, foreign buyers can consult with Pin Homes Real Estate, who provide hands-on advice, project comparisons, and access to both off-plan and ready properties.

Dubai’s transparency, clear regulations, and attractive returns make it one of the most reliable international property markets for foreigners in 2026.

Disclaimer

This article is for informational purposes only and does not constitute financial or legal advice. Property investments carry risk. Buyers should conduct independent due diligence or consult qualified professionals before making any investment decisions.

Recent Posts

For More Details

Pin Homes Real Estate LLC

Contact Real Estate Experts